GREEK TECH IN 2020 & PREDICTIONS FOR 2021

Introduction

2020 was a record year for the Greek ecosystem, as the Greek startups succeeded in raising more capital than ever before, reaching as high as 455€ millions, an increase that was over 71% compared to 2019. At the same time, two major acquisitions were held last year, which resulted in the Greek ecosystem entering the global innovation map. Moreover, Greek startups also generated an impressive rise in new jobs which was as high as 30%. All the above are signs that the Greek ecosystem has now reached a maturity stage.

At this critical juncture for the Greek innovation ecosystem, it was essential that Endeavor Greece cooperated directly with the founders of the companies, as they were the protagonists of this progress, in order to capture in numbers what happened in the Greek ecosystem in 2020, and to gain an understanding of its development profiles ensuring that new opportunities will continue to emerge.

As a result, we performed the first market analysis that has been validated by the entrepreneurs themselves. A total number of 567 startups participated in this analysis, with 208 out of which having offices and/ or employees in Greece, while 359 have been founded by Greek Entrepreneurs in foreign countries. For the needs of this report, the second category is being referred to as “Diaspora” and has been analyzed in a separate unit so that the homogeneity of the sample and the conclusions are preserved.

The analysis at hand constitutes the first step towards the creation of an open-access platform, whose aim is to provide founders of startups, Greek and international investors, along with everyone who takes a direct interest in the Greek ecosystem with accurate comparative data essential for any strategic decision-making.

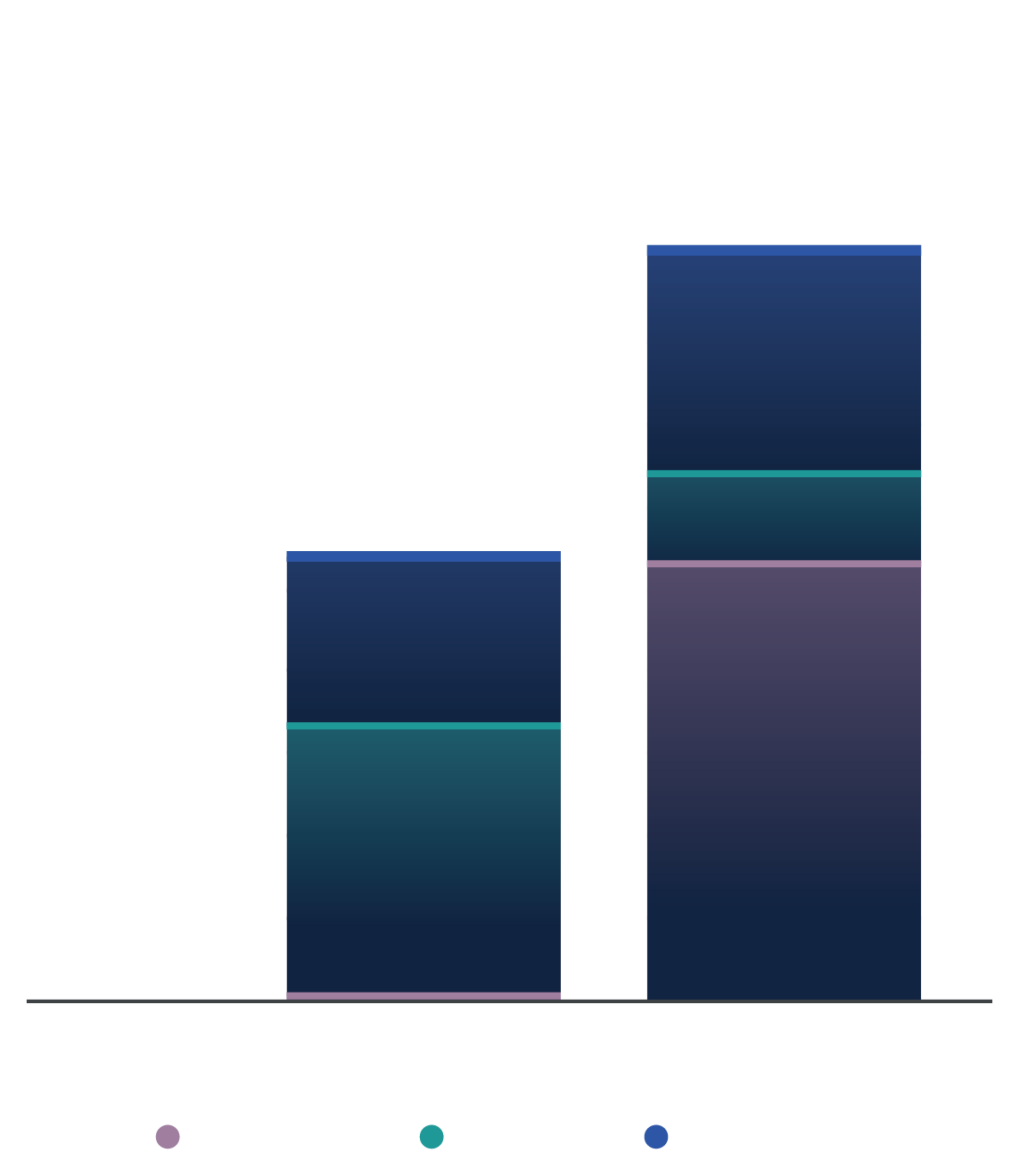

Funding

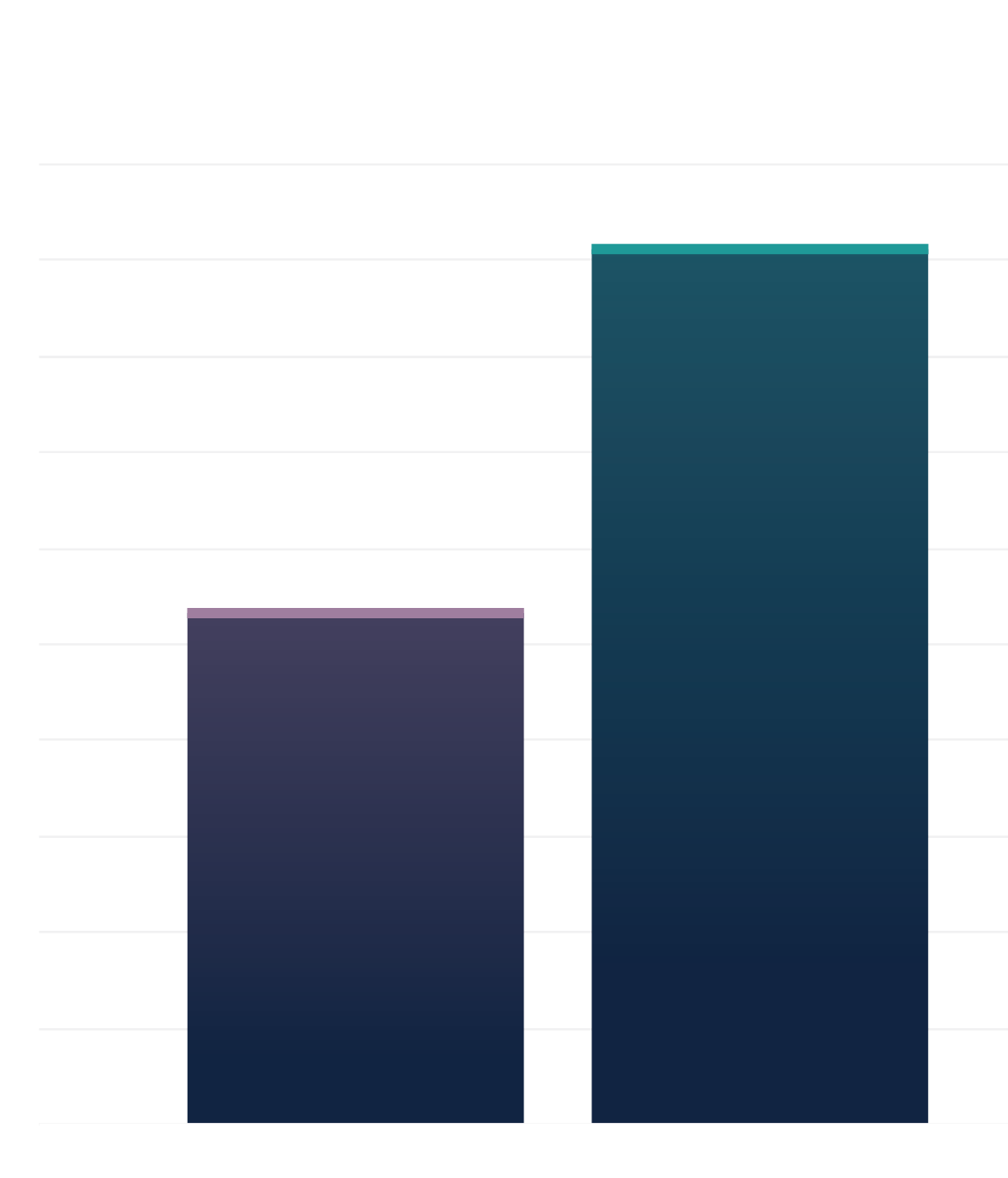

In 2020 the Greek startups succeeded in raising more capital than ever before, reaching as high as 455€ millions, an amount that was 71% higher than the 266€ millions invested in the Greek ecosystem in 2019. What is noteworthy is that, in spite of the fact that the total amount of funding has risen considerably, there has been a 17% decrease in the funding rounds; namely, in 2019, 79 funding rounds were held, while in 2020 there were no more than 65. This fact is not necessarily a negative development, as the amounts in every funding round were considerably higher, and older companies continued to raise capital so as to increase their growth rate. The largest funding round held in 2020 amounted to 75€ millions, taking into consideration the amounts that have officially been announced, and it was the one of Viva Wallet.

After the last financing round, Viva Wallet is relatively high in the list of the top 10 Greek companies having received the largest funding since their establishment, which turns them into the “outliers” of the Greek ecosystem and increases the attention of international investors for Greece.

The 10 Greek companies having received the largest funding:

* The companies above appear in alphabetical order, and it has absolutely no relevance to the amount of funding they have received.

** For the needs of the present report, the amounts have been converted into euros, and there might be slight discrepancies.

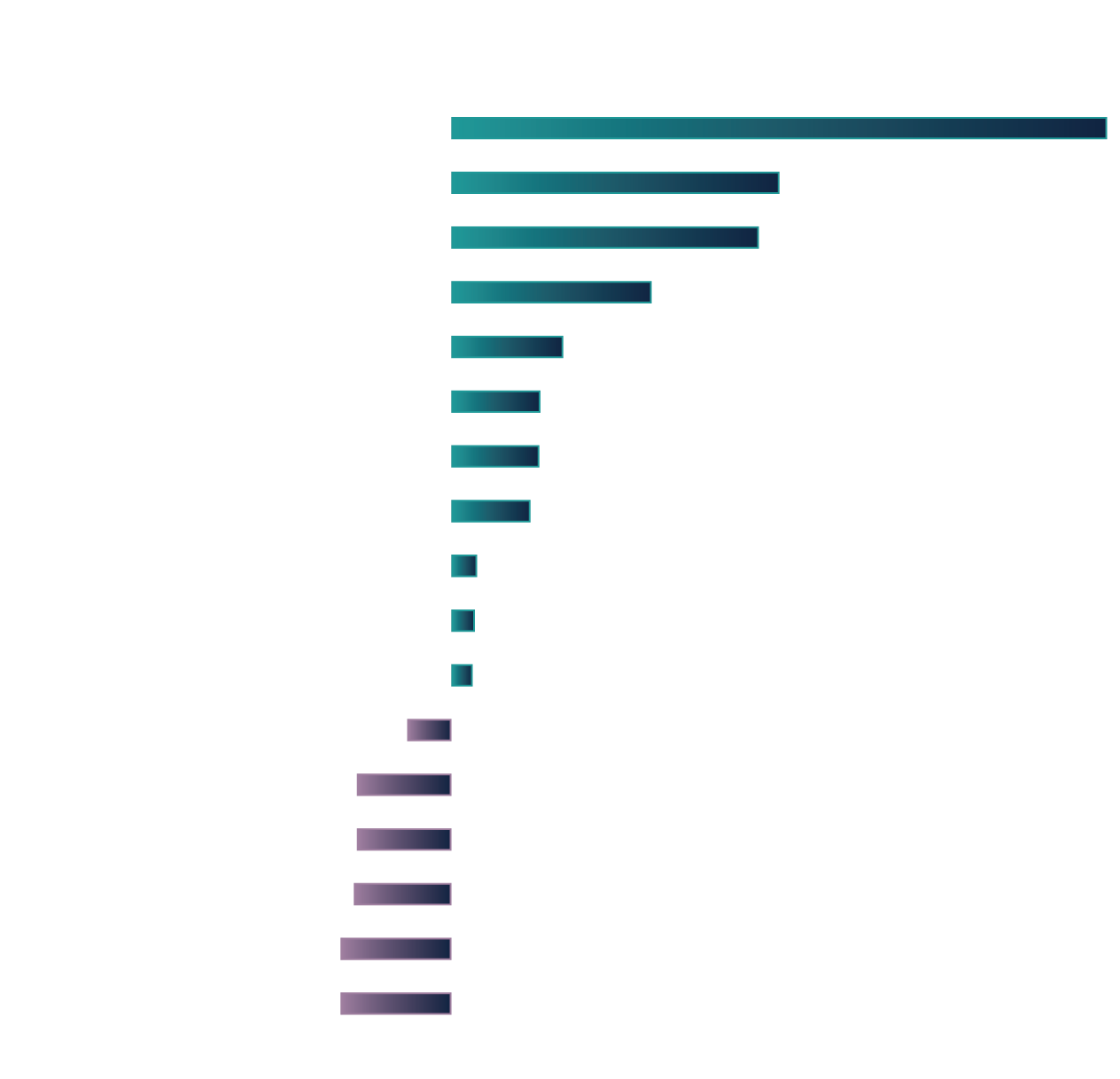

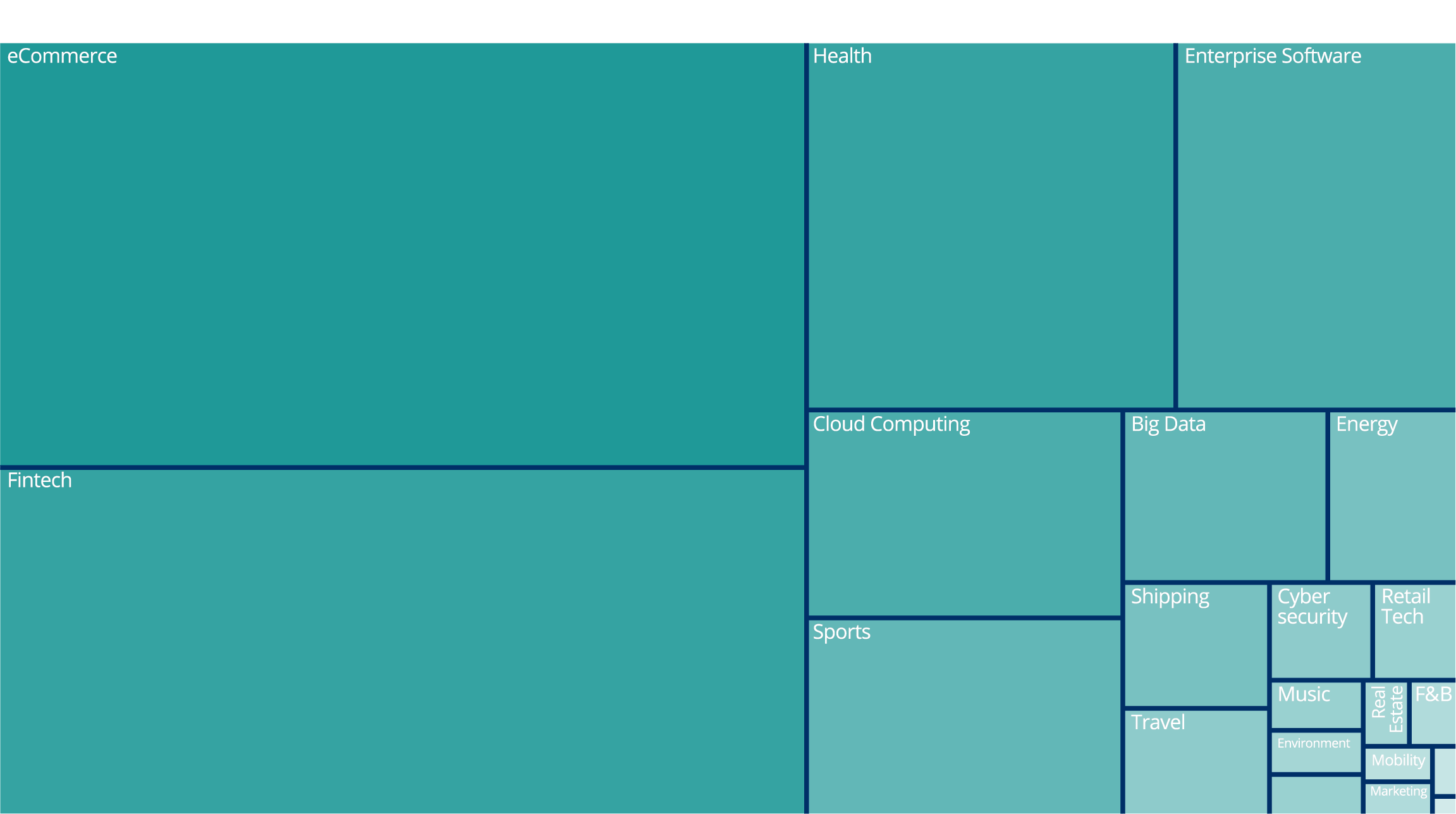

Examining closely the distribution of the capital raised per sector last year, we come to the conclusion that the Fintech and the eCommerce verticals see the largest increase amounting to 600% and 300% respectively, whereas the sectors of Education, Agriculture, , Travel etc. undergo a considerable decline, which amounts to 100%.

The eCommerce vertical received 27% of the total funds raised in 2020, which is the largest amount invested last year. Next to follow is the Fintech vertical with 21%, while the Health vertical is third in the row having received 10% of the total funds raised last year.

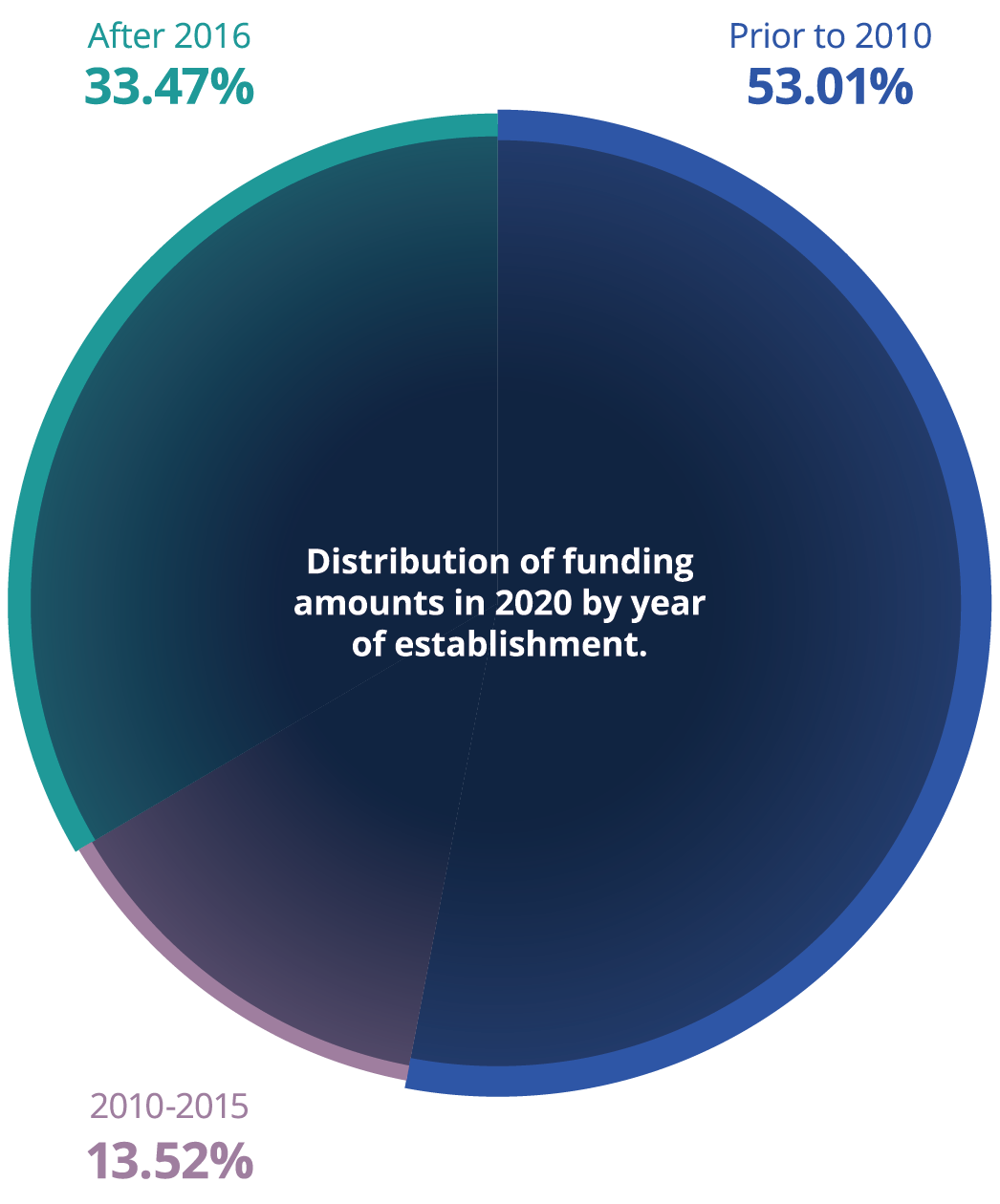

Some extremely interesting points emerge if the distribution of the invested capital is viewed in relation to the year of the companies’ establishment. In 2020, 53% of the total capital was channelled to companies that were founded prior to 2010, while the younger companies with less than 4 years of operation received 33,47 percent of the total capital. Companies with 5 to 10 years of operation raised just 13,5% of total capital invested in 2020.

Having compared the above mentioned amounts with the relevant ones of 2019, it can be concluded that there has been a considerable increase in the capital invested not only to companies that have been active for more than 10 years, but also to newly founded companies that have been operating for less than 4 years. On the contrary, companies that have been active for 5-10 years seem to experience a downward trend in fundraising in 2020.

The new generations of entrepreneurs seem to access large scale investment funds more easily compared to companies that were founded more than a decade ago and they needed more time to reach the scale-up phase. Skroutz and Viva Wallet constitute very good examples of this trend, as they raised large funding rounds in 2020, having been active for 15 years. Consequently, it is estimated that such large-scale deals will be achieved within shorter time periods since the establishment of a Greek startup in the future.

It is worth to be noted that more and more foreign investors participate in the Greek startups. This fact multiplies the growth opportunities of the Greek ecosystem, because apart from the direct impact of the resources offered, it creates a significant global network around the entrepreneurs, which provides quality talent, great collaborations and strategic guidance.

Here are some of the largest international funds that have led or participated in funding rounds of Greek startups:

Acquisitions

2020 was a record year for the Greek startup ecosystem with regard to acquisitions as well, as Greek entrepreneurs have awakened the interest of global technology players, having accomplished deals that exceed 470€ millions, the highest amount ever for the Greek standards. The acquisitions that singled out in 2020 were undoubtedly the ones of Instashop (Delivery Hero), Softomotive (Microsoft) and Think Silicon (Applied Materials), accompanied by smaller-scale acquisitions, such as the ones of Adveos (Beken Corporation), Pushme (TIER Mobility), Blendo (RudderStack) and Guestflip (Travelbook Group).

InstaShop

InstaShop, founded in Dubai in 2015 by Greek entrepreneurs John Tsioris and Ioanna Angelidaki, was acquired by the German Delivery Hero for about €300 millions ($360 millions). It was one of the largest acquisitions in the Middle East and the largest acquisition for a company of Greek business interests.

The company’s model proved to be extremely profitable within the first five years of operation, and the company received less than €6 millions of invested capital from the Greek VentureFriends and the Jabbar Internet Group. InstaShop continues its operation as an independent brand and its leadership team reinforces the current q-commerce strategy of Delivery Hero in the region.

Delivery Hero seems to have a great deal of confidence in the talents of Greek founders, as it has acquired several Greek platforms, such as efood, clickdelivery.gr and deliveras.gr.

Softomotive

Softomotive, which was founded in Athens in 2005 by Marios Stavropoulos and Argyris Kaninis, was acquired by the tech giant Microsoft. The amount of acquisition has not been officially announced yet, but it is estimated to be around €125 millions ($150 millions) and it is the largest acquisition of a Greek startup to the present day.

Softomotive is considered to be one of the first companies that entered the sought-after market of Robotic Process Automation (RPA), offering a software that has been used in the automation of computer processes performed by a user or an employee. It is one of the top 10 startups that have received the highest funding in Greece, having raised a total of more than €20 millions ($25 millions) from the investment company Grafton Capital.

The announcement of Softomotive’s acquisition was followed by the decision to create an R&D center based on the RPA technologies, which is directly linked with the acquisition of Softomotive. Microsoft seems to place a special interest in the Greek ecosystem, as in 2020 it announced an investment as high as €400 millions destined for the establishment of a Data Center in Attiki, which is one of the first Data Centers of the company in Europe. All the above actions show the importance and the multiplier effect that an acquisition can have in the local economy, since the investors are not limited to the initial investment, but they develop an entire ecosystem of investments around the initial one.

Think Silicon

Think Silicon, which was founded in 2007 at the Patras Science Park by George Sidiropoulos and Iakovos Stamoulis, was acquired by the American Applied Materials, which is considered to be one of the most important companies of Silicon Valley. Although the total amount of the acquisition has not been officially announced yet, it is estimated to be as high as €30 millions, and as a result, it is one of the largest acquisitions in the tech field in Greece.

Think Silicon is active in the field of semiconductors and specializes in the design and development of high-performance and low-power GPUs for wearables, Internet of Things, domestic appliances and industrial design monitors, while serving customers from all over the world. It is worth noting that Think Silicon’s management and staff are still based in Patras and in Athens, and they continue to develop their ambitious technology products and expand their growth plan in the field of electronics and semiconductors.

Applied Materials holds a leading position in materials technology for the production of computer chips and advanced monitors in the world. It is present in 18 countries, and by carrying out a number of acquisitions, it has more than 22,000 employees and holds over 13,300 patents.

The person behind the acquisition of Think Silicon is Kostas Mallios, Corporate Vice President and General Manager, Applied AI at Applied Materials, who also played a central role in the acquisition of Innoetics by Samsung. This fact is a clear indication of how important it is that the members of the Greek diaspora remain active and connected to the Greek ecosystem. The significance of the multiplier effect is also evident; any person having a good experience with the ecosystem remains connected to it and contributes to the creation of new opportunities.

Job Creation

It has been proved that startups play a significant role in job creation, especially over a period of time. Beat, efood and Skroutz are typical examples of this, as they are among the fastest growing employers of the country. Although the number of new jobs created by startups seems to be relatively small compared to the overall number of new positions created in Greece every year, it does not cease to follow an upward trend and it provides the community with thousands of new jobs.

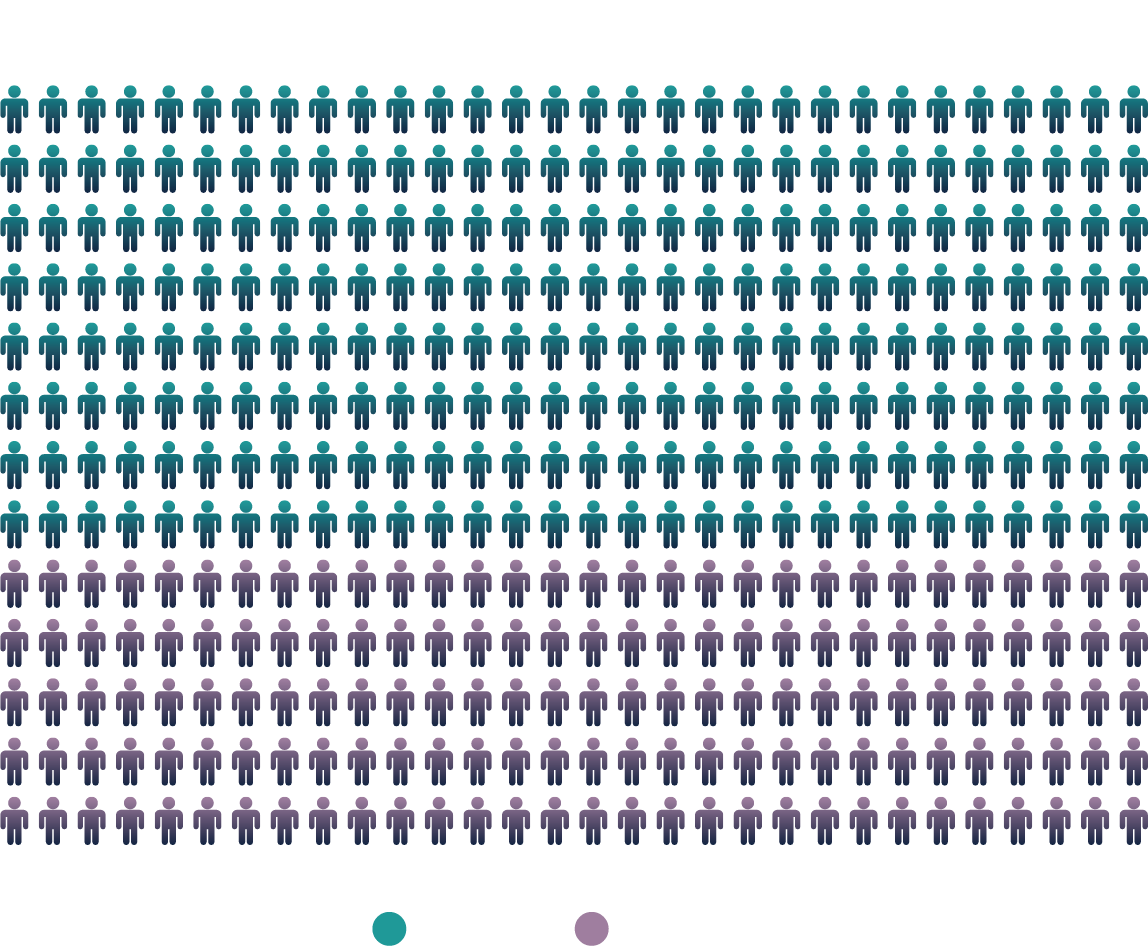

2020 was a very particular year for the field of employment, as a lot of companies were forced to carry out extensive layoffs in order to survive the pandemic. According to the Hellenic Statistical Authority, after seven years of continuing job growth, in 2020 there has been a decline of 0,9%. However, this decline does not pertain to the majority of the Greek startups, as the total number of jobs in startups rose by 30%. In 2019, 5.400 people were working in startups, and by the end of 2020 this number has risen to 7,000 employees.

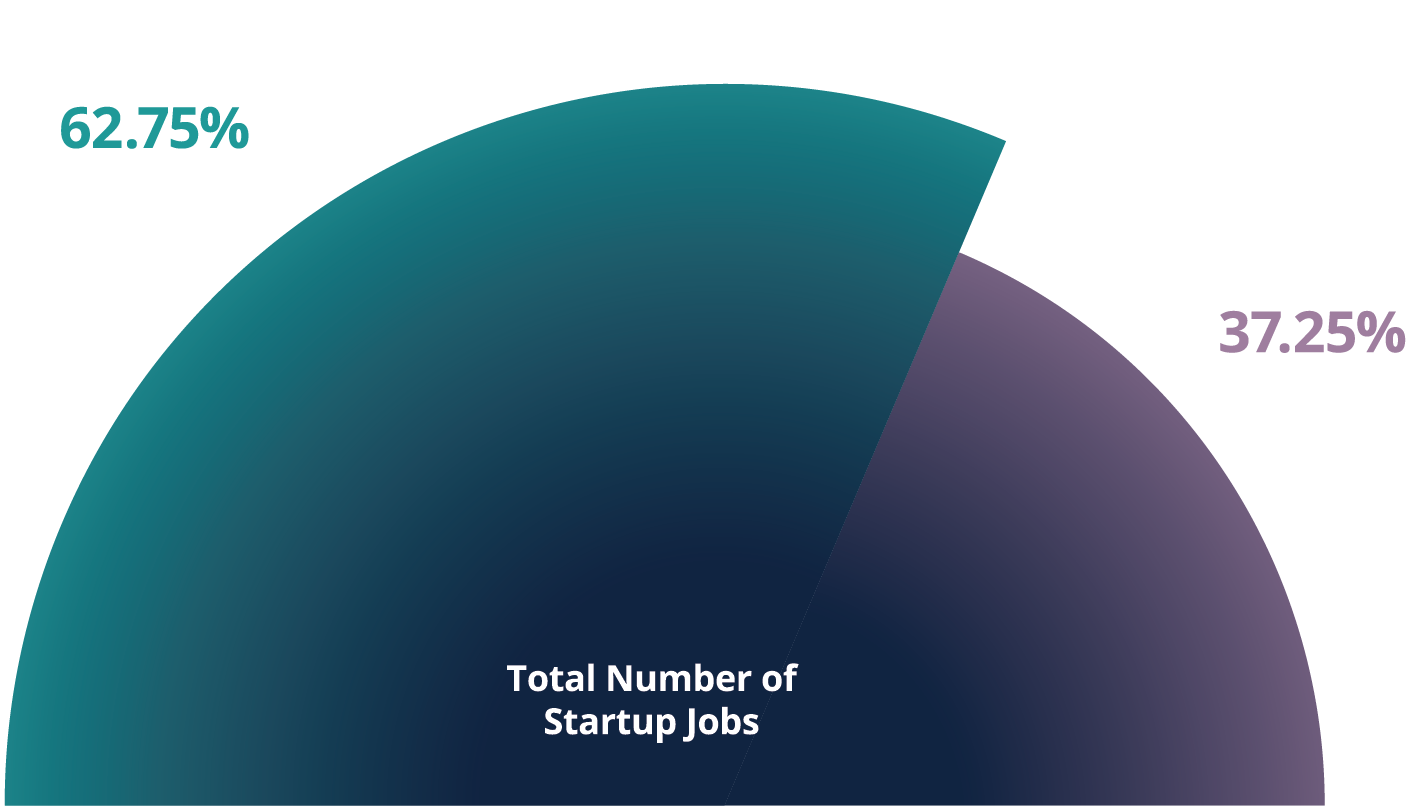

A very important development in the field of employment in 2020 was the shift to remote working, which gave the opportunity to Greek startups to “open up” their teams to international talent, and to startups from abroad to look for talent in Greece. As a result, in 2020, 62% of the new jobs created in startups are based in Greece, and the rest 38% is based abroad, most of which being located in the USA and the United Kingdom.

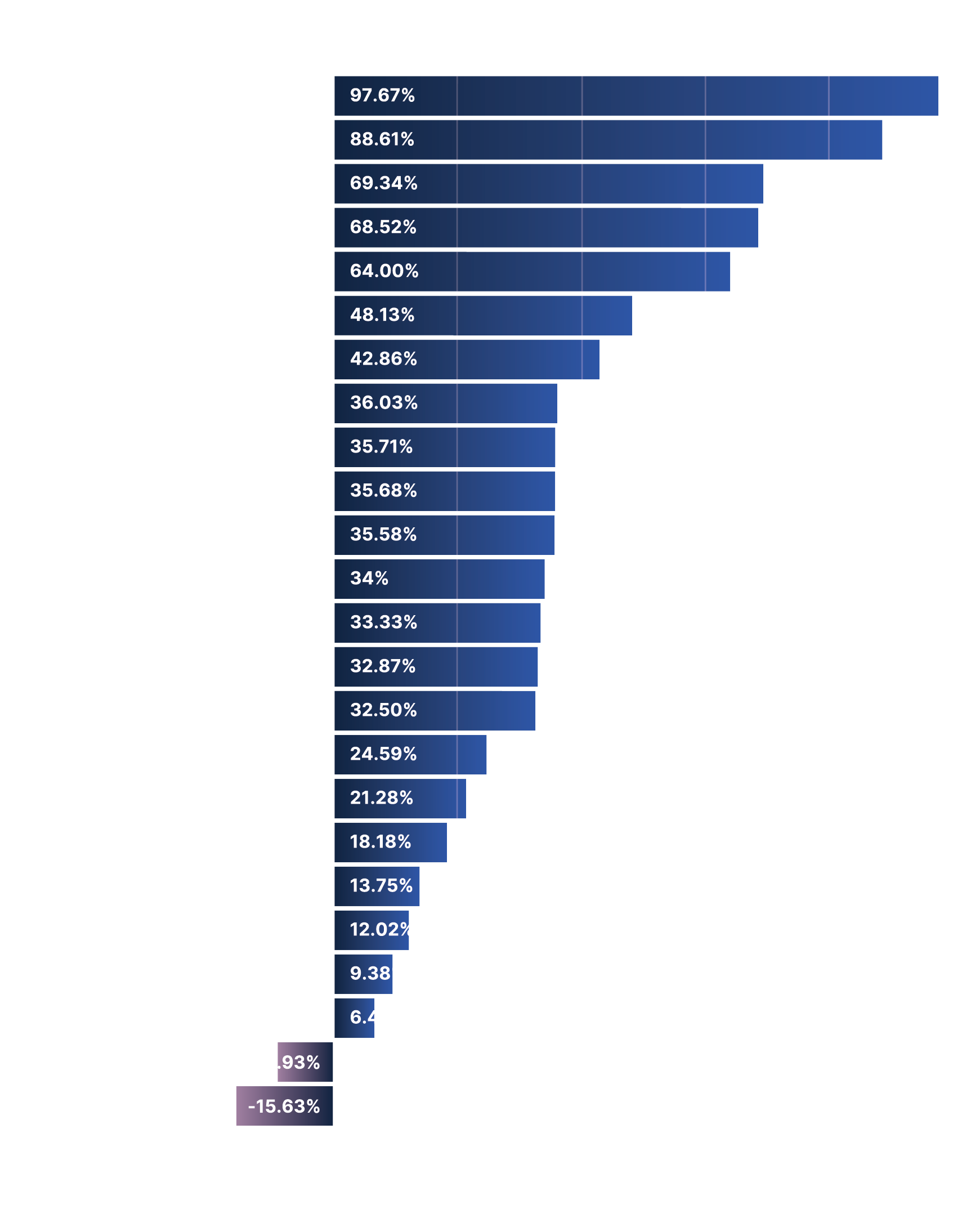

A more detailed look at the change in the growth rate of employment in startups by sector in 2020 shows that there has been a significant decrease in job creation in the sectors of Travel and Sports. These sectors have been affected by the pandemic and a large number of companies resorted to staff reductions. On the contrary, startups operating in the Cybersecurity sector nearly doubled (+97,7%) the job opportunities they created last year compared to 2019, while the sectors of eCommerce and Music follow next with an increase as high as 88,6% and 69,3% respectively.

It is of great interest that 20 companies that find themselves at the top of the list with the largest startups provide approximately 63% of the total number of new jobs created by startups every year.

Here are the top 10 startup employers in 2020,

based on the number of their employees until December 31, 2020.

The Opportunity of the Greek Diaspora

The Greeks of the diaspora present undoubtedly a very important opportunity for the development of the Greek ecosystem, as they are successful founders of sophisticated companies, talented academics and professionals with know-how in sectors, which in our country are underserved. The Greeks of the Diaspora constitute a source of inspiration, knowledge, talent and wealth, as they have developed a wider network that keeps growing and is currently 3 times bigger that the Greek one.

Indicatively, out of a total number of 567 companies with a Greek background that were identified in the context of this research, 359 of them were founded by Greeks that were outside the geographical borders of the country. The other side of the Atlantic presents a lot of interest, with the “Greek” activity concentrated in San Francisco and New York, where 25% of the identified companies are located. Equally important is the presence of the Greek founders (20%) in London and in the wider area of the United Kingdom. Germany is another country that has gathered a number of Greek entrepreneurs, most of whom are based in Berlin (5%). Last but not least, it is worth noting that in the context of the present research we identified Greek founders scattered in major ecosystems, ranging from Canada and Australia to Brazil and Hong Kong.

One further indicator of the size of the Greek Diaspora is the amount of the total funding that companies with Greek founders from abroad received, which was as high as 1,56€ billions in 2020, which is 3 times higher than the total amount raised by companies based in Greece (455€ millions).

Apart from the advanced technologies they have generated, the economies of scale they enjoy, and the total amount of funds they have raised, the valuation of these companies resulting from all the above should also be taken into consideration, as it is exceptionally high for the Greek standards. A typical example is Cameo founded by Greek-born Steven Galanis, which has been valued at 1$ billion after its recent funding of 100$ millions.

DNAnexus’ last financing round was equally noteworthy, as it closed at 100$ millions with the participation of investors from top funds from abroad, such as GV (Google Ventures), First Round Capital, as well as Regeneron, the cofounder of which is George Yancopoulos, another member of the Greek Diaspora.

Lastly, the Greek innovation ecosystem can greatly benefit from the Greek presence in successful companies operating abroad, and its proper connectivity with the diaspora can yield not only significant resources, but also access to a global network that can skyrocket its potential.

What we expect in 2021 | Companies that will stand out

As we are approaching the end of the first half of 2021, we notice that within just 5 months the invested amounts have already reached 50% of the total capital raised last year, and 2 out of 3 Greek entrepreneurs point out that they are planning to raise a new funding round in 2021. We estimate that 2021 will be a record year for all key indicators: growth rates, job creation, attracting funds, acquisitions (both in value and actual number).

The watchlist with the companies that are expected to be at the heart of the ecosystem with their success is diverse. On the one hand, there are companies that have already evolved into global players and keep growing (Outliers), such as Blueground, Epignosis, Hellas Direct, NetData, Persado, Pollfish, Omilia, Orfium, Viva Wallet and Workable.

On the other hand, there are companies that are currently building their success stories and are expected to undergo considerable growth and remarkable financing rounds next year (Rising Stars). Such examples are Arrikto, Augmenta, Causaly, Hack the Box, Intelligencia, Lenses, LearnWorlds, Manual, Panther Labs, Plum, Saphetor, Spotawheel, TileDB.

Conclusion

Looking ahead, it is our aspiration that Endeavor Insights evolves into the first open-access platform in Greece, aiming to generate various benchmarks to empower entrepreneurs in key decision-making moments, as well as to provide important data to anyone stakeholder interested in the progress of the Greek ecosystem.

Consequently, we will be publishing yearly analyses on the course of the ecosystem, which will be based 100% on information provided by the entrepreneurs themselves. This is extremely important for two reasons. Firstly, it is essential to capture the overall picture of the Greek innovation industry and its size, which will help shape a strong narrative and will contribute to its promotion worldwide. Secondly, the entrepreneurs of our country will be provided with invaluable access to benchmarks, which will be created through the Endeavor Insights platform.